Deep (Energy) Takes: Betting on Long-Duration Energy Storage (LDES)

In our previous deep (energy) takes posts, we explored why solar and wind alone won’t be enough—and how their long-term viability depends on the support of long-duration energy storage (LDES).

This post dives deep into the future of long-duration energy storage (LDES), exploring why it's essential for stabilizing a renewable-powered grid and replacing firm generation sources. I examine the economic and technical challenges of LDES, highlighting that only technologies with ultra-low energy capacity costs—such as sulfur flow batteries, metal-air batteries, compressed air storage, and thermal systems—have a shot at scaling. I also lay out the key design parameters that will determine which storage technologies succeed in a crowded and capital-intensive market.

Which LDES Solution Will Win?

The Department of Energy defines long-duration energy storage (LDES) as any system capable of storing energy for more than 10 hours. While that’s technically accurate, it falls short of what’s needed economically. LDES systems likely need to store energy for over 100 hours to be cost-effective. Exactly how much longer remains uncertain, but what we do know is this: lithium-ion batteries (outside of transportation) and storage solutions in the 10–100 hour range are not economical enough to scale.

Let’s examine the key parameters LDES must meet to reduce electricity costs and displace firm generation. Princeton Professor Jesse Jenkins and McKinsey Partner Nestor Sepulveda published a comprehensive study on which types of LDES could remain economically viable over the next two decades. Why spend years building a realistic design space for LDES? The context is simple: it’s no longer controversial to say that rapid decarbonization is affordable. As Professor Doyne Farmer’s research shows, the faster we decarbonize, the more trillions we save—thanks to the steep and ongoing cost declines in solar, wind, and battery technologies.

Unfortunately, the rapid adoption of solar and wind comes with its own set of challenges. These are intermittent energy sources—they don’t produce electricity around the clock, while our demand for power is constant. As solar and wind make up a growing share of the electricity mix, we’re left with two options to maintain grid reliability.

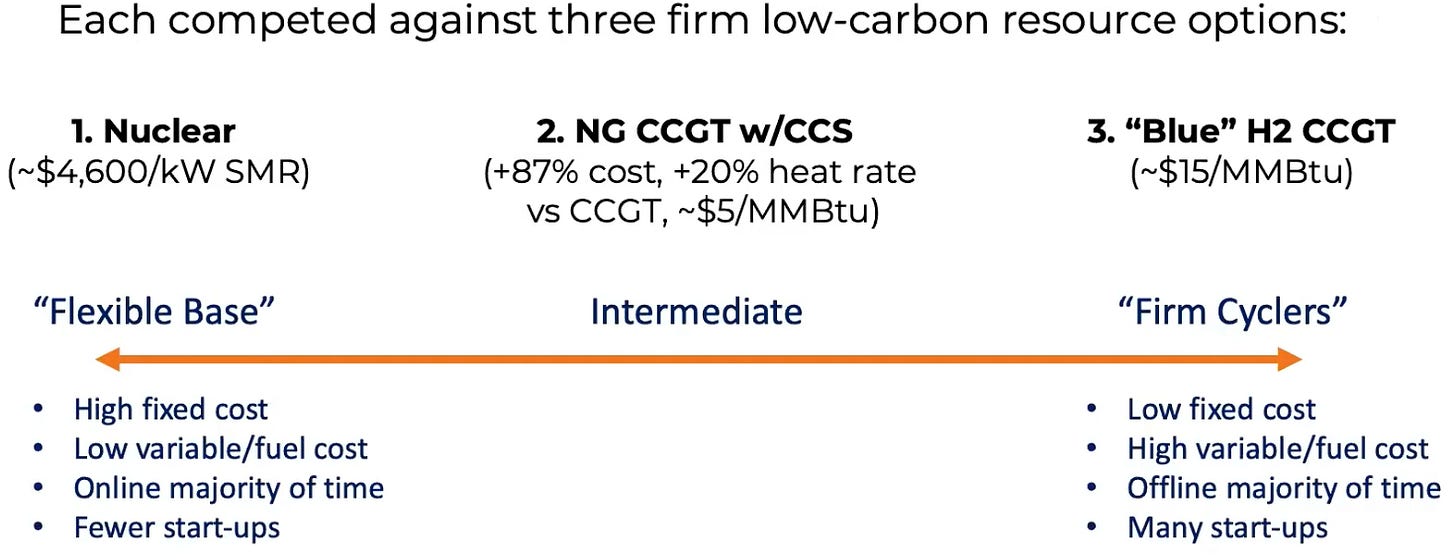

The first option is to rely on firm electricity generation—sources like natural gas and nuclear plants that can provide power 24/7 to balance out the intermittency of renewables. Currently, the U.S. grid includes around 850 GW of capacity from fossil fuel plants and about 100 GW from nuclear. In a net-zero future, the goal is to replace coal and natural gas with low-carbon firm alternatives. Several candidates could play a key role, including advanced Generation IV nuclear reactors (designed to be meltdown-proof), geothermal energy, and systems that burn zero-carbon fuels like hydrogen.

The second option is to store excess energy generated from solar and wind during the day and use it when those sources aren’t available. Like solar and wind projects, all storage technologies come with high upfront costs. To be economical, those costs must be spread across many charge-discharge cycles—costs that ultimately show up on your electricity bill. The benchmark to beat is lithium-ion batteries, which are relatively cost-effective for durations under 10 hours.

Let’s walk through a simple example. Imagine the sun doesn’t shine for an entire day, cutting off your solar power supply. Fortunately, you have a lithium-ion battery pack that stores 20 kWh of excess electricity—enough to power the average U.S. household for about a day.

The cost of using that stored energy depends on the battery’s price, financing terms, and lifespan. A typical 20 kWh battery system might cost around $4,500—$3,000 for the battery itself and about $1,500 in financing at 7% interest. Assuming the battery lasts 5,000 cycles, that works out to $0.90 per cycle or $0.045 per kWh just for storage. When added to the $0.10/kWh cost of solar generation, your total cost becomes $0.145/kWh—about 45% more than using solar directly during the day, just for the battery provider to break even.

We can extend this example to understand why seasonal LDES is so challenging from a business perspective. Suppose instead of 5,000 cycles, the battery is only used 200 times. The cost per cycle would jump, bringing the amortized cost to around $1.20/kWh—roughly 12 times more than simply using solar power during the day. This illustrates a key issue: storage systems have high upfront capital costs that become uneconomical when spread across too few cycles. The problem is especially acute for LDES technologies with lower cycle life. On top of that, all storage systems face degradation and ongoing maintenance costs, regardless of how often they’re used.

So, what can we take away from this example? Before LDES can play a meaningful role in grid stabilization, it needs to pass a basic economic test. That means: low capital costs, the ability to cycle frequently, and large storage capacities.

This raises the natural question: what specific performance metrics do LDES systems need to hit to be cost-effective—or even reduce electricity costs? And can they ultimately replace the need for firm electricity generation?

Researchers Nestor Sepulveda, Jesse Jenkins, and their team tackled this question by exploring five key design parameters for LDES systems to determine which ones have the greatest impact on reducing electricity costs:

energy storage capacity costs ($/kWh)

charge power capacity costs ($/kW)

discharge power capacity costs ($/kW)

charge efficiency (%)

discharge efficiency (%)

Their findings can help us focus our energy (pun not intended) on innovation on a narrower range of design parameters. First, they found that energy storage capacity costs and energy discharge efficiency were the parameters to focus on if you can only improve one or two parts of a system. Energy storage capacity costs refer to the capital required to provide one kWh of storage. This makes intuitive sense—lower upfront costs make the system more affordable overall. High discharge efficiency is also essential; the less efficient the system, the more storage capacity it needs to deliver the same amount of usable energy. According to the study, energy capacity costs must drop to around $20/kWh to reduce electricity costs by 10% or more.

Second, the study shows that firm generation is unlikely to be fully replaced—especially as we move toward widespread electrification. The only scenario in which LDES could fully displace clean firm generation is if energy capacity costs fall to $1/kWh or less, a threshold achievable only by a small subset of geographically constrained technologies.

Finally, the study found that more than half of the LDES design space offered less than a 10% improvement in electricity costs—insufficient to meaningfully reshape the US energy system. While initial deployment could happen at around $50/kWh, LDES technologies will only start making a significant impact in the $5–20/kWh range. The most promising candidates in the $1–10/kWh bracket include compressed air storage ($1–30+/kWh), hydrogen power ($1–15+/kWh), firebrick resistance-heated storage ($5–10/kWh), multijunction photovoltaic thermal systems ($8–36/kWh), metal-air batteries ($5–20/kWh), and aqueous sulfur flow batteries ($10–20/kWh). Other technologies within the $10–20/kWh range include pumped hydro storage ($1–30+/kWh) and reciprocating heat pumps ($15–25/kWh).

Let’s use this study as a framework to evaluate four major categories of long-duration energy storage: electrochemical, chemical, mechanical, and thermal. We’ll set aside chemical storage for now, as that will be the focus of a future deep (energy) takes post.

Electrochemical: Sulfur Flow and Metal Air

In the electrochemical storage space, a number of startups are developing low-cost, battery-like systems aiming to become the lithium-ion equivalent for long-duration storage. To avoid the supply chain challenges tied to rare earth minerals, many of these technologies rely on more abundant, readily available materials. Of the various approaches, only two contenders appear likely to endure over the next decade: sulfur flow batteries and metal-air batteries.

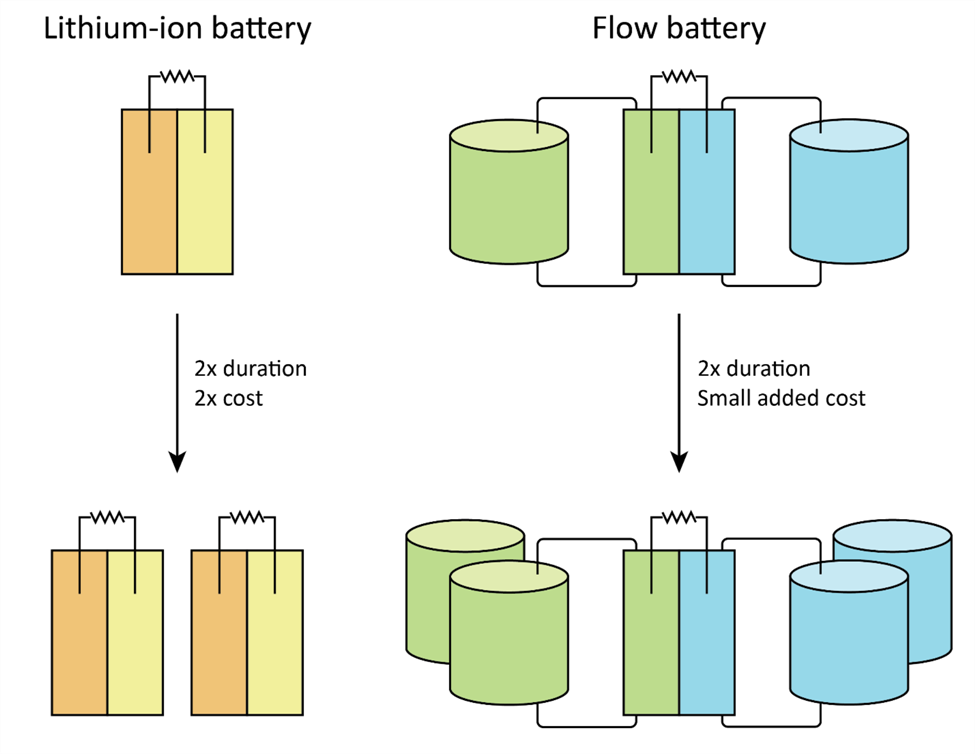

Flow batteries offer a key advantage: the ability to scale energy storage capacity and power output independently. Unlike lithium-ion batteries, which store energy within solid materials, flow batteries store energy in dissolved metals within an aqueous electrolyte. The system uses two separate tanks—one for the anolyte and one for the catholyte. Pumps circulate these fluids past electrodes, where they remain separated by a thin membrane that allows ions to pass but not the liquids themselves. This ion exchange generates electricity. A variety of metals—including vanadium, zinc, and iron—are used as electrolytes, depending on the specific chemistry.

In flow batteries, power output is determined by the size of the electrodes, while energy capacity depends on the volume of the electrolyte. This modularity is a significant advantage. Unfortunately, lithium-ion batteries are already eating the flow battery’s lunch, as three to four-hour lithium systems consistently outperform any flow battery on the market. Lithium-ion batteries are battle-tested, with well-understood lifetimes and failure rates, making them easier to finance and deploy. As a result, their maintenance costs are relatively low—about 1% of capital—compared to at least 2.5% for flow batteries. Despite these headwinds, one promising contender remains: aqueous sulfur flow batteries, which theoretically could reach energy storage capacity costs as low as $10–20/kWh.

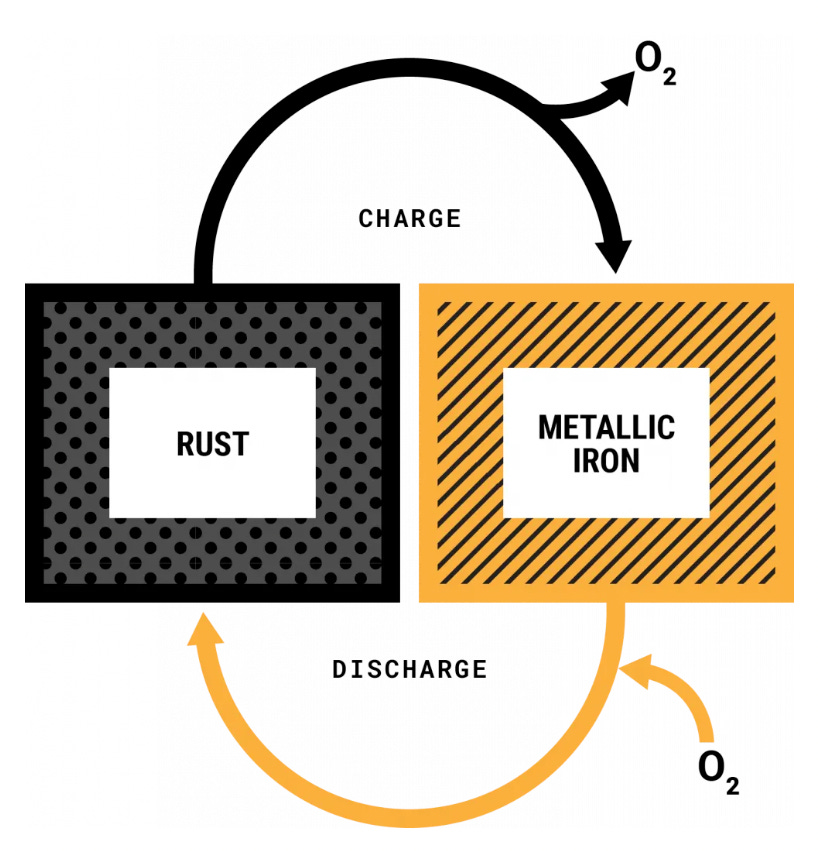

Metal-air batteries are also in the race, with a theoretical energy capacity cost of around $20/kWh. Form Energy leads the field, whose “reversible rusting” battery uses iron as the cathode and air as the anode. Powered by renewables, it can deliver more than 100 hours of discharge when needed. CEO Mateo Jaramillo is betting that utilities will grow increasingly wary of investing in coal and natural gas plants due to the rising risk of stranded assets—facilities designed to last 30 years could be forced offline in just 10 to 20 if carbon pricing or regulation ramps up.

This macro trend is likely to unfold—but timing is everything. The viability of Form Energy’s approach hinges on how quickly the grid embraces cheap renewables and phases out natural gas. If decarbonization mandates are delayed, or corporate enthusiasm cools, the company’s window of opportunity could shrink.

Sulfur flow and metal-air batteries (like any renewable energy infrastructure project) still need to prove they’re bankable. Lithium-ion batteries have benefited from decades of deployment and refinement, making their performance and failure rates highly predictable—an important factor for risk-averse investors. That level of certainty doesn’t yet exist for newer technologies, meaning early backers must shoulder significantly more risk. Compounding the challenge, installation costs for these emerging systems are so high that the battery itself often represents only a fraction—sometimes just a quarter—of the total project cost.

Mechanical: Pumped Hydro and Compressed Air Storage

The most promising mechanical LDES systems are pumped hydro and compressed air storage. Pumped hydroelectric energy storage (PHES) works by pumping water from a lower reservoir to a higher one, then releasing it through a turbine to generate electricity. While PHES currently accounts for the majority of global energy storage, it generally isn’t economical for true long-duration applications. Only large-scale projects with reservoirs capable of storing energy for over 100 hours can approach energy capacity costs of $20–30/kWh—just enough to begin competing with firm generation in select scenarios.

Compressed air energy storage (CAES) is another promising mechanical LDES technology, with potential energy capacity costs as low as $1/kWh. CAES systems store energy by compressing air and releasing it to drive a turbine when electricity is needed. A related approach—using compressed hydrogen in underground caverns or porous rock formations—can also deliver extremely low storage costs, ranging from $1 to $5/kWh in hard rock sites. We will be exploring the future of hydrogen, hydrogen storage, and other chemical storage solutions in a lot more depth in a future deep (energy) takes post.

The cost-effectiveness of both PHES and CAES is highly dependent on geography. PHES requires access to sufficiently large and elevated water reservoirs to be viable. Similarly, CAES is most economical when it can tap into large saline aquifers; costs increase significantly when using less ideal formations like salt caverns.

Thermal: Firebrick Resistance-Heated, Reciprocating Heat Pumps

The final potential LDES solutions we will cover are thermal firebrick storage and reciprocating heat pumps. Firebrick-based thermal storage heats dense, highly heat-resistant ceramic bricks with electrical resistance heaters when excess renewable energy is abundant. Once heated, these bricks can store thermal energy for weeks with minimal losses due to their excellent insulating properties. When electricity demand peaks, air or steam is passed through the heated bricks to generate electricity through a turbine or provide heat directly for industrial processes. The simplicity and low-cost materials involved—primarily bricks, steel, and insulation—give these systems a projected storage cost as low as $5–10/kWh, making them attractive for widespread deployment.

Pumped thermal energy storage, specifically systems utilizing reciprocating heat pumps, operates by using electricity to drive heat pumps, transferring heat from a cold storage reservoir to a hot reservoir during periods of energy surplus. When energy is needed, the heat flow reverses, and thermal energy from the hot reservoir is converted back to electricity. Reciprocating heat pumps are efficient, modular, and can be scaled flexibly according to storage duration requirements. Their expected energy storage capacity costs range from $15–25/kWh, making them economically competitive in the mid-duration storage market.