Deep (Energy) Takes: The Future of Geothermal Energy - Part 2

Geothermal Policy and Regulatory Inflections, Geothermal's Potential for a True Energy Renaissance

Hi Deep (Tech) Takes Friends! 🧑🔬👋

In the last post, we explored why geothermal—despite supplying less than 0.5% of U.S. electricity—is emerging as one of the most promising clean energy sources for the decades ahead. We covered the core technologies (hydrothermal and EGS), the massive untapped energy potential beneath our feet, and how drilling innovations from the shale revolution push geothermal down the cost curve.

Today, we’re diving into the policy and regulatory moves that could make or break geothermal’s future. From federal R&D and tax incentives to permitting reform, we’ll unpack what it’ll take to unlock private capital and get projects in the ground. But the real story? Geothermal’s renaissance won’t just come from better wells or smarter subsidies—it’ll come from its superpower: delivering firm, dispatchable power.

Policy Inflections: DOE Push and Pull Mechanisms

Technological advancements may spark a revolution—but they’re only half the story. Without the smart policy and regulatory shifts of the late 20th century, the fracking boom would have taken decades longer to materialize. In this section, we’ll unpack the key policies oil and gas companies leveraged—and why geothermal startups should be fighting for similar support. While incentives are in place to accelerate geothermal development, they’re still too weak to close the cost gap with solar, which today enjoys a levelized cost of electricity (LCOE) two to three times lower.

Private fracking pioneers like Mitchell Energy (highlighted in Part 1) relied heavily on direct federal R&D support to accelerate their breakthroughs. Specifically, Mitchell utilized DOE-funded mapping techniques and geological research to decode the complexities of underground shale formations. Even the transformative PDC drill bits (read technical inflections section for more details), now synonymous with efficient shale drilling, originated in government research programs aimed at non-shale applications. DOE cost-sharing agreements further mitigated the financial risks of early exploratory drilling, enabling Mitchell to advance more rapidly.

Yet R&D funding alone wasn't enough. Economic incentives were equally crucial in turning shale into a scalable, commercially viable industry. The Unconventional Gas Credit, a production tax credit available until 2002, encouraged shale gas development by making it more competitive with conventional fuels. This policy not only doubled natural gas production over the next two decades but, more importantly, accelerated incremental technological improvements. By the time the credit expired, unconventional gas production had become economically viable on its own. The credit saved producers nearly $10 billion, as they sold their credits to larger firms through tax equity financing transactions.

Complementing this production-focused credit was another critical incentive—the Intangible Drilling Deduction (IDC). This policy allowed drillers to immediately deduct non-salvageable expenses like wages, fuel, and maintenance, rather than depreciating them over several years. While the IDC was available to the broader drilling industry, it disproportionately benefited shale operations, where intangible costs accounted for roughly 85% of total drilling expenses, compared to around 70% for conventional wells. By providing immediate tax relief, IDC significantly lowered barriers to entry, further catalyzing shale’s rapid commercial growth.

The shale revolution succeeded because producers strategically leveraged government R&D grants, cost-sharing programs, and generous tax subsidies. Today, geothermal stands at a similar inflection point but faces tougher hurdles. Equity investors, while comfortable with technology risk, generally favor projects with smaller upfront capital requirements. Meanwhile, tax equity investors—primarily large banks with ample compliance resources—prefer solar and wind projects offering predictable, double-digit returns. Geothermal projects, with their higher upfront costs and limited track record, also struggle to attract private lenders, particularly in today’s high-interest-rate environment.

All that leaves geothermal startups with a giant gap in their wallets. So, what funding tricks can geothermal pull from the shale playbook—and what moves can Uncle Sam make right now to bridge the gap?

The federal government gives some support by using several push mechanisms—directly subsidizing upfront costs—primarily through R&D grants. The Geothermal Technologies Office (GTO) offers the most targeted support toward the commercialization of EGS and advanced geothermal exploration and drilling. In late 2023, the GTO announced a $165 million grant to use the skills of the oil and gas industry in geothermal development. This initiative could significantly boost efficiency and innovation, helping geothermal technologies move from the lab to the broader market. Additionally, the GTO oversees the Frontier Observatory for Research in Geothermal Energy (FORGE), a dedicated test site for EGS technology. FORGE’s research into creating and maintaining underground fracture networks has already reduced development risks, allowing startups like Fervo to accelerate their path from pilot to commercial viability.

The Advanced Research Projects Agency-Energy (ARPA-E) has also provided millions in capital for different geothermal projects worldwide. While this support is valuable, creative financial structures have proven to be even more impactful in driving innovation. A notable example is ARPA-E’s 2009 investment of $9.1 million in Foro Energy to develop laser-assisted drilling technology. Unlike typical grants, Foro was required to repay this funding in full, with interest. This approach allowed Foro to maintain ownership of its intellectual property and simplified subsequent fundraising from private investors.

Despite these valuable contributions from the GTO and ARPA-E, federal support for geothermal remains limited. The Loan Programs Office (LPO), intended to fund innovative clean-energy projects too risky for private markets, has yet to provide affordable debt financing for next-generation geothermal initiatives. Furthermore, geothermal’s existing tax incentives pale in comparison to those that fueled the shale boom. Currently, geothermal projects are eligible for up to $25 per MWh produced during their first decade of operation. Given geothermal’s present costs—ranging between $181 and $450 per MWh—this subsidy does little to close the competitive gap, leaving new geothermal power plants struggling to become financially viable.

The DOE should also adopt pull mechanisms—strategies that secure demand for a product and “pull” it to market—similar to NASA’s successful approach in de-risking space projects. Through the Commercial Orbital Transportation Services (COTS) program, NASA established milestone-based contracts with private space companies, guaranteeing demand while ensuring accountability. A key aspect of the program was that companies had to secure independent financing, allowing NASA to cut support for projects that failed to meet critical benchmarks.

Regulatory Inflections: NEPA and CEs

In the late 20th century, fiscal policy played a crucial role in shaping the trajectory of riskier, high-cost energy ventures like shale gas. Today, however, regulatory reform has emerged as an even more influential factor—particularly for geothermal energy. Let’s examine the key regulatory shifts that will determine whether geothermal can scale effectively and penetrate the U.S. energy market.

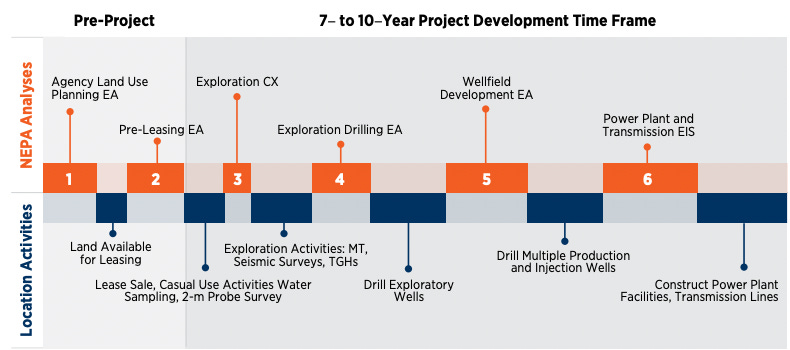

Under the National Environmental Policy Act (which we covered in depth in this deep takes post), geothermal energy projects must undergo a full environmental review before exploration and another before final production development. This process can take seven to ten years, significantly limiting geothermal’s ability to iterate and scale quickly. It also deters investors, as developers struggle to provide realistic project timelines until years into development.

Meanwhile, oil and gas get a shortcut: categorical exclusions (CEs) that skip most of the bureaucratic headaches. The impact of Trump’s executive order declaring a national energy emergency on geothermal remains to be seen. However, there is reason for cautious optimism—the order explicitly defines energy to include “crude oil, natural gas, lease condensates, natural gas liquids, refined petroleum products, uranium, coal, biofuels, geothermal heat, the kinetic movement of flowing water, and critical minerals.” This allows Congress to establish a legislative CEs for geothermal exploration.

Geothermal can’t wait a decade every time it wants to dig a hole. We need to let it run.

Geothermal’s True Renaissance: Flexible EGS, Closed Loop Systems vs Baseload

So far, we've explored the technological breakthroughs that position geothermal as a prime candidate for achieving true energy abundance. We've also examined the crucial policy and regulatory shifts required for geothermal to compete effectively with lower-cost renewables like solar and wind. But perhaps the most significant inflection point still lies ahead: the inevitable evolution of the U.S. energy mix and the rapidly changing dynamics of the electric grid. The result? Geothermal could soon go from overlooked to unstoppable, ushering in a true geothermal renaissance!

In our previous post on energy learning curves, we discussed how the marginal cost of electricity generation is expected to trend toward zero by 2030 due to the rapid expansion of renewable energy. As a result, utilities are increasingly adopting renewables, as it is in their best financial interest to purchase the cheapest electricity available.

States like California and Texas have already accelerated their renewable energy adoption, leading to dangerously low net load levels on the grid. The duck curve best illustrates this phenomenon, which shows the impact of midday energy oversupply. At peak solar generation, utilities are sometimes forced to pay other grid operators to absorb the excess electricity. Meanwhile, as the sun sets, energy ramp rates become even steeper, making grid management increasingly challenging as renewables scale.

Two types of power generation can help manage increasing grid variability: baseload and firm (dispatchable) power. Baseload power, like nuclear energy, runs continuously to meet the minimum energy demand on the grid. Firm power, like natural gas plants, can be dispatched on demand, providing flexibility without needing to operate 24/7 like baseload power.

Geothermal energy is uniquely positioned to capitalize on the growing instability of the grid and the shortcomings of U.S. energy infrastructure. Achieving firm, dispatchable power is geothermal’s holy grail. Geothermal is one of the only energy sources in the world that can economically operate both as a baseload and a firm energy source. Nuclear energy isn’t cost-effective for dispatchable power, while hydropower, though dispatchable, is geographically constrained.

Hawaii’s Puna Geothermal Venture is currently the only commercial facility that has successfully demonstrated flexible geothermal operations, adjusting its output between 38 MW and 22 MW. However, startups like Fervo Energy and Eavor are also making strides in this space.

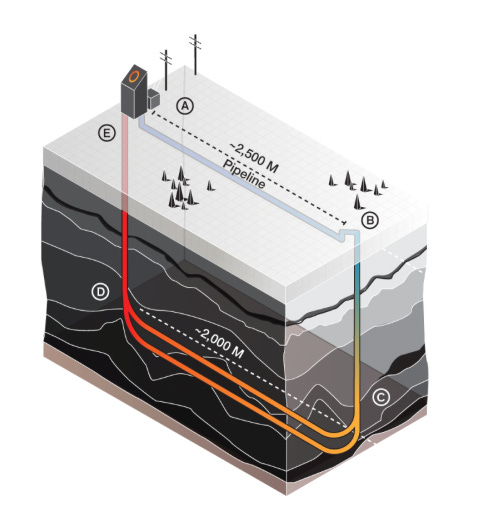

Fervo Energy successfully demonstrated its FervoFlex trial at the end of 2023, showcasing geothermal’s potential for flexible power generation. Eavor, meanwhile, is developing a closed-loop geothermal system called Eavor-Lite. This system circulates convection fluids in a sealed loop: cold fluids are injected, heated by conduction from hot rock formations, and returned to the surface to generate electricity. Unlike traditional geothermal, closed-loop systems don’t rely on permeability or a reservoir—only a sufficiently high underground temperature. However, this approach has a fundamental limitation: conduction-based heat transfer is constrained by the laws of physics, capping how much thermal energy the system can extract.