Deep (Hydrogen) Takes: Inflections for Scaling Green Hydrogen and Why U.S. Electrolyzer Strategy is Misguided

Hydrogen Supply Part Two: Electrolyzers 101, Inflections needed to reach a $1/kg LCOH2, and Why U.S. electrolyzer strategy is on the wrong track!

Hi Deep (Tech) Takes Friends! 🧑🔬👋

Last time, we started talking about the hydrogen supply and why steam methane reformers (SMRs) produce such cheap hydrogen:

We’re diving back into the hydrogen supply story by zooming into the trickiest part: making clean hydrogen using electrolyzers. I first introduced electrolyzers with energy learning curves and why they earn a spot in the energy industry’s magnificent four.

In this post, we dive deeper into why the U.S. electrolyzer development strategy is on the wrong footing. A lot will need to happen for electrolyzer companies to stick the landing (getting to $1/kg).

We begin by examining how far U.S. green hydrogen costs are from the aspirational $1/kg target. We then break down the four main types of electrolyzers and highlight three inflection points needed for green hydrogen to achieve cost parity with grey hydrogen. In the final section, we outline the most pressing open questions and summarize key takeaways about the state of U.S. hydrogen supply. You should skip to the last two sections of this post if you are already familiar with electrolyzers.

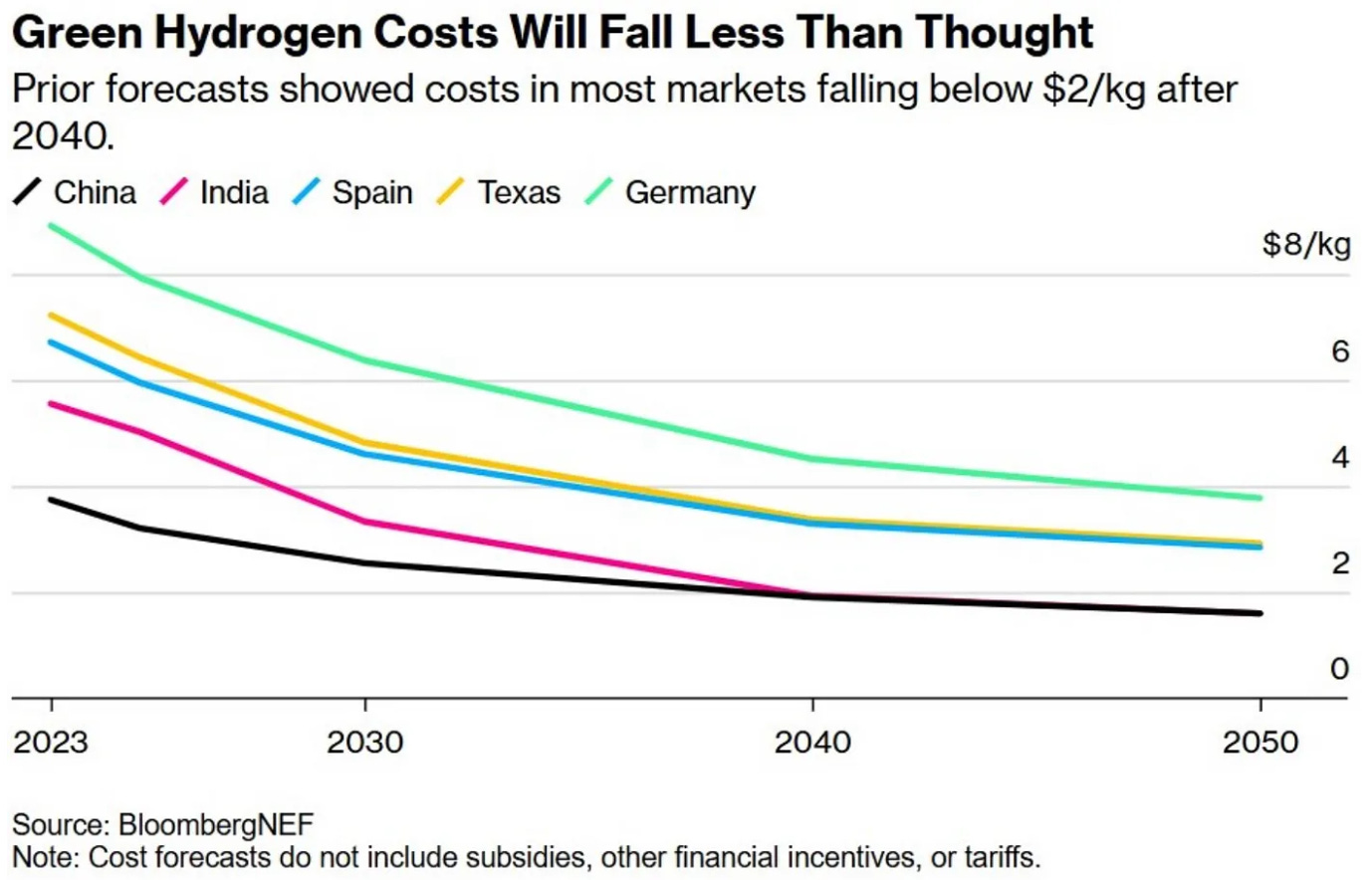

Electrolyzers: Why Hydrogen Can’t Avoid Subsidies for Now

In 2021, electrolyzers were the golden child, touted as the tech that would finally bring green hydrogen down to $1/kg by 2031. BloombergNEF, a trusted name in energy forecasting, predicted PEM-produced green hydrogen would drop to $2/kg by 2030—good enough to beat blue hydrogen. Morgan Stanley was even bolder and projected that in the best U.S. renewable hotspots, green hydrogen could hit the $1/kg mark in just a few years. The optimism was real.

Fast forward to today: The mood is a lot more cautious. Sure, electrolyzers are still riding the learning curve, but the numbers aren’t as pretty. BloombergNEF now projects green hydrogen will land somewhere between $1.60-5.09/kg by 2050. Compare that to grey hydrogen, which is expected to stay comfortably in the $1.11-2.35/kg range. If this plays out, green hydrogen might only be cost-competitive in two places by 2040: China and India. Both have cheap renewables and manufacturing scale that are driving prices down. In the U.S.? Even the most affordable green hydrogen in Texas is projected to be around $3/kg by 2050.

The last thing we want is for green hydrogen producers to rely heavily on government subsidies to decarbonize transportation, chemical production, and hard-to-abate sectors like steel and cement. Unfortunately, electrolyzers are currently the only green hydrogen production pathway that stands a chance of reaching cost parity with grey hydrogen. So let’s dive into the heart of the issue: what are the main types of electrolyzers, and how can they help bring green hydrogen costs down to $1/kg?

For those already familiar with electrolyzers, feel free to skip to the inflections section!

Let’s start by breaking down an electrolyzer into its basic components. An electrolyzer is a device that splits water (H₂O) into hydrogen (H₂) and oxygen (O₂) using electricity. Because you're breaking strong O–H bonds in water, the reaction requires an input of energy (called an endothermic reaction, like the steam reforming reaction we discussed in our last post). For all four types of electrolyzers, the overall chemical reaction is:

2H₂O → 2H₂ + O₂ (Water in, Hydrogen and Oxygen out!)

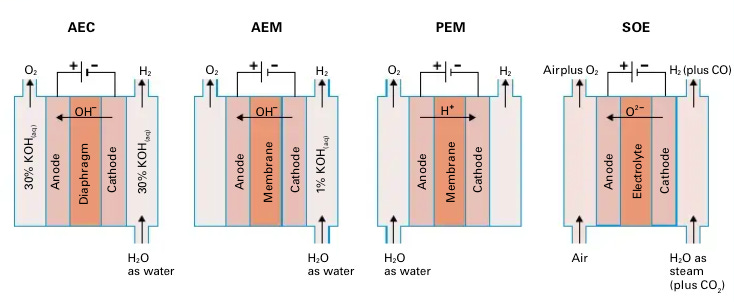

Every electrolyzer consists of three components: an anode, a cathode, and an electrolyte. Each electrolyzer has different reactions that occur at the anode and cathode, but together, they all add to the overall water-splitting reaction above.

Take the Proton Exchange Membrane (PEM) electrolyzer. At the anode, water molecules are oxidized—meaning they lose electrons—to form oxygen gas (O₂), protons (H⁺), and electrons. This half-reaction is known as the oxygen evolution reaction (OER). The electrons leave the anode and travel through an external circuit to the cathode, while the hydrogen ions (H⁺) pass through the PEM membrane. At the cathode, these protons meet the incoming electrons and are reduced—gaining electrons—to form hydrogen gas (H₂).

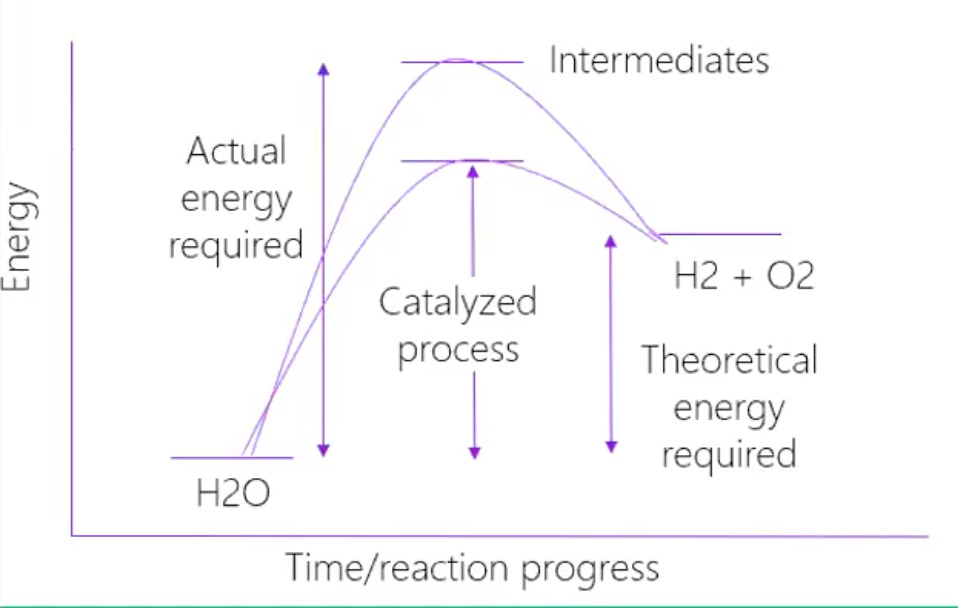

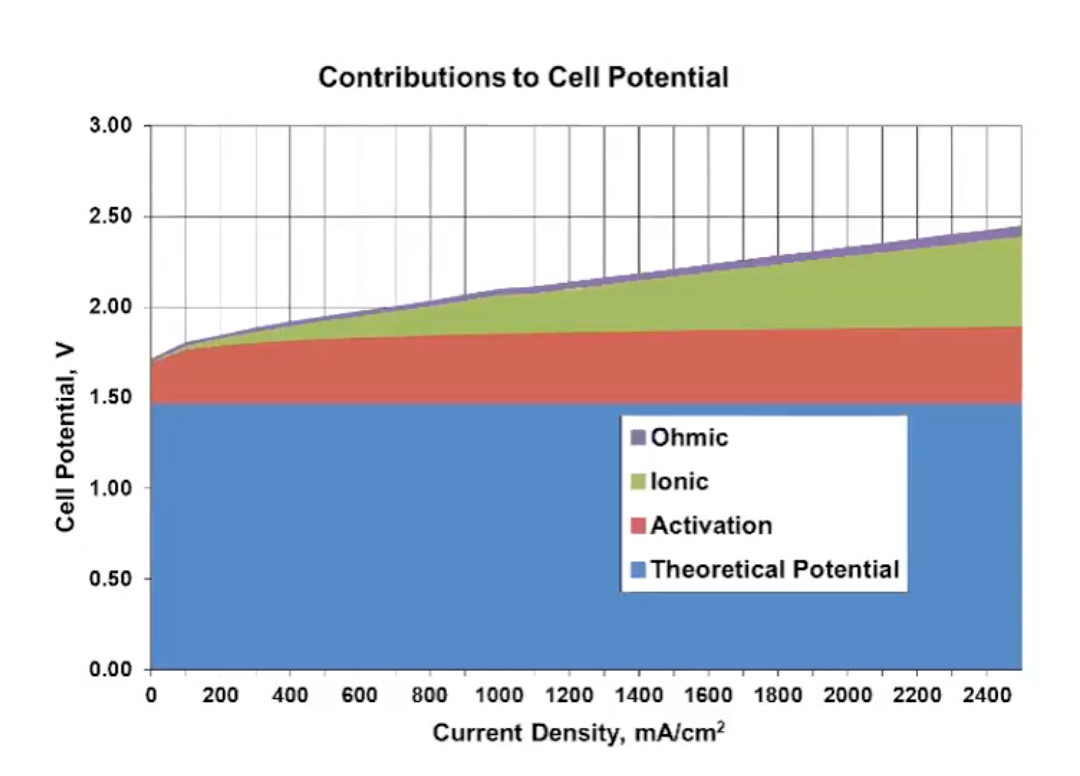

The advantages and disadvantages of each type of electrolyzer stem from the distinct materials and architectures they use. For instance, some electrolyzers use expensive catalysts, which are materials that increase the rate of reaction by lowering the activation energy required (see graph above) for a reaction to take place, without being consumed.

Alkaline vs Proton Exchange Membrane Electrolyzers:

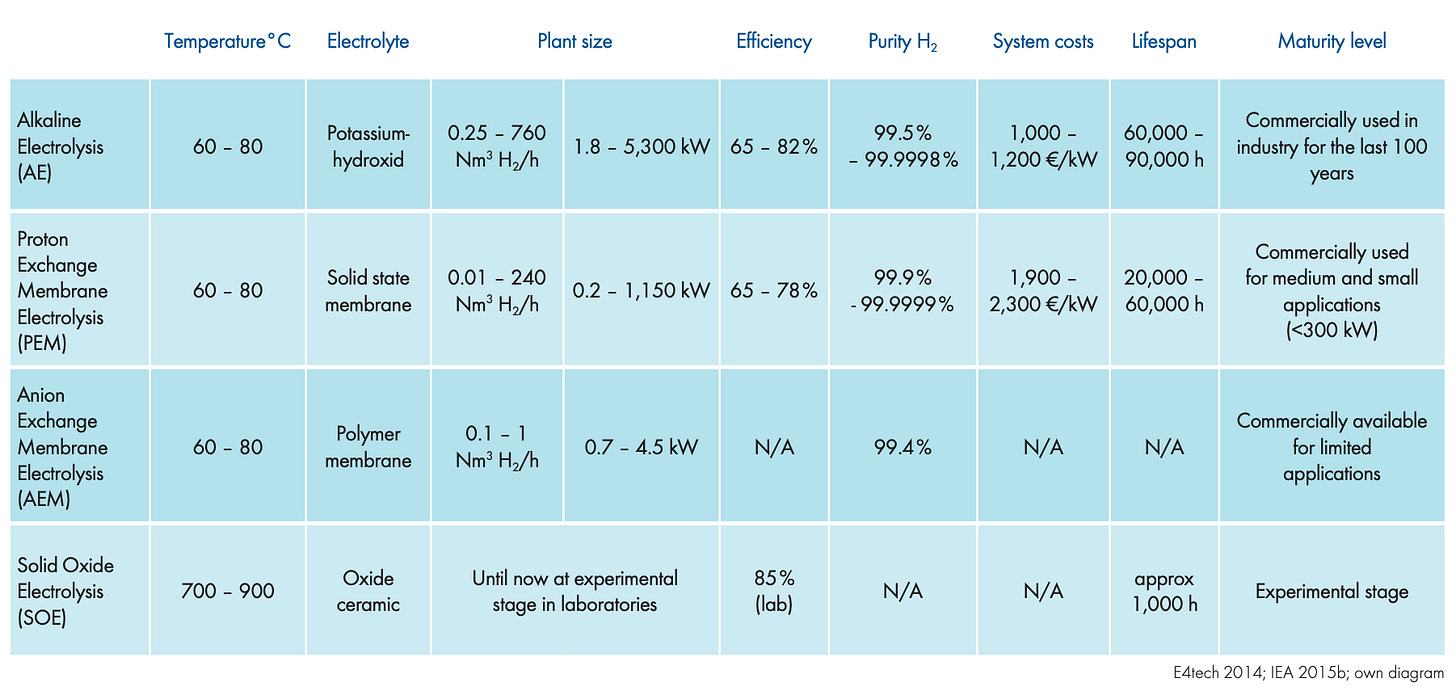

The two mature technologies on the market today are Alkaline Electrolyzers (AE) and Proton Exchange Membrane (PEM) Electrolyzers. AEs have been around for over a century. Over 70% of installed global electrolyzer capacity is AE-based, with Chinese manufacturers leading in cost-effective production. AEs were originally developed for industrial applications that require a constant, steady supply of hydrogen—an area where they excel. They operate at low current densities and have slower dynamic response times, making them poorly suited for pairing with variable renewable energy sources like wind or solar.

PEM electrolyzers, by contrast, were developed for life support systems in space, where compactness and reliability were paramount. They are more compact than AEs and use an expensive iridium catalyst that is about a third of the PEM total stack’s cost. Their solid polymer membrane allows protons (H⁺) to move rapidly through the cell, enabling fast dynamic response times ideal for intermittently powered renewable systems. This responsiveness makes PEMs a strong candidate for green hydrogen powered by solar and wind.

Anion Exchange Membrane and Solid Oxide Electrolysis Electrolyzers:

The newer players are Anion Exchange Membrane (AEM) and Solid Oxide Electrolysis (SOE) electrolyzers. While both are commercially available, they are still early in their deployment and limited in scope. Startups like EVOLOH are advancing AEM electrolyzers that have solid membranes, similar to PEMs, but instead transport hydroxide ions (OH⁻) instead of protons. They also rely on inexpensive nickel or cobalt electrodes, similar to AEs. The key challenge for AEMs is membrane durability. The alkaline environment filled with reactive OH⁻ ions is much harsher than the acidic environment of PEMs, leading to faster membrane degradation. Today, AEM systems typically last only around 3,000 hours, compared to 60,000 hours for mature AE or PEM stacks—a 20x difference.

SOE systems, made by companies like Bloom Energy, use ceramic electrolytes and operate at high temperatures (~800°C), which sets them apart from all other electrolyzers. These high temperatures reduce the electrical energy input required, accelerate reaction kinetics, and allow for integration with industrial processes—such as steel, cement, and glass manufacturing—that already operate at elevated temperatures. SOEs can also reuse high-temperature waste heat, improving overall efficiency. However, their biggest weakness lies in their poor material reliability. The ceramic layers are brittle and prone to cracking under even minor mechanical stress. Additionally, different materials in the cell expand at different rates under heat, making them vulnerable to microcracks and delamination if the system undergoes frequent on-off cycling.

Inflections Needed for Green Hydrogen Demand

Green hydrogen from electrolyzers costs a little over $7/kg in Texas and just under $4/kg in China. If we can't bring that price down to $1/kg, a green hydrogen economy simply won't materialize—there won’t be enough demand to justify the buildout. So what would it take to reduce the cost of green hydrogen to $1/kg between 2040 and 2050? Let’s walk through the key inflection points needed to make this future possible.

The key inflections needed for green hydrogen are ultimately tied to levelized cost (LCOH₂): the cost of renewable electricity must go down, the electrolyzer plant’s capacity factor, and the cost and efficiency of the electrolyzer itself.

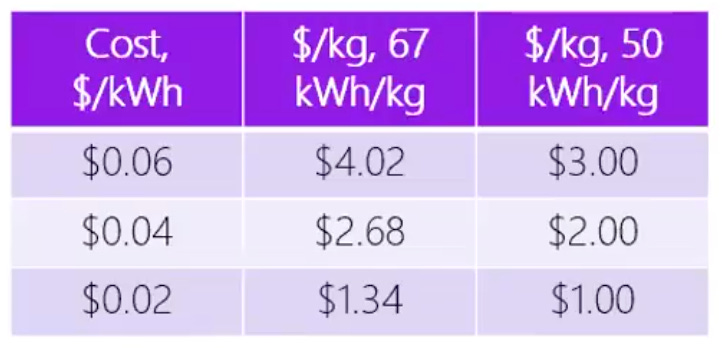

The first and most critical lever is the cost of renewable electricity, which accounts for over half of the levelized cost of hydrogen (LCOH₂). To achieve cost parity with grey hydrogen, the levelized cost of renewable energy must fall to at least $0.02/kWh. Fortunately, renewable prices are continuing to decline, thanks in large part to the magnificent four (we wrote about in our learning curves post). As we saw in our analysis of energy through the lens of geopolitics, industrial electricity tariffs in countries like Qatar and Saudi Arabia have already reached lows of $0.05/kWh through utility-scale solar projects. The key question now is how quickly the marginal cost of electricity in the U.S. approaches zero.

The second lever is the electrolyzer plant’s capacity factor. An electrolyzer plant’s capacity factor is the ratio of the actual hydrogen produced over a given period to the maximum possible output if the plant operated at full capacity 24/7.

Earlier, we discussed the three-headed hydra destabilizing the U.S. electrical grid, with one key factor being the rapid adoption of solar and wind, leading to fluctuating electricity availability throughout the day. But this isn't just a uniquely American issue. Take Spain and Portugal, for example—both countries experienced a major electrical outage this month, during a period when solar accounted for nearly 60% of total generation and wind another 9%.

Hydrogen producers can capitalize on periods of surplus electricity resulting from grid instability. As renewable costs continue to fall, producers will increasingly locate hydrogen facilities near clusters of renewable energy sources, effectively increasing their combined capacity factor. For instance, solar farms have low capacity factors of around 20%. In comparison, offshore wind installations can approach 60%. If a hydrogen plant is collocated next to both of them, the plant’s capacity factor can be much higher. Other emerging solutions like long-duration energy storage (LDES) and beefed-up power lines (connecting various renewable farms) mean these electrolyzer plants could run practically around the clock.

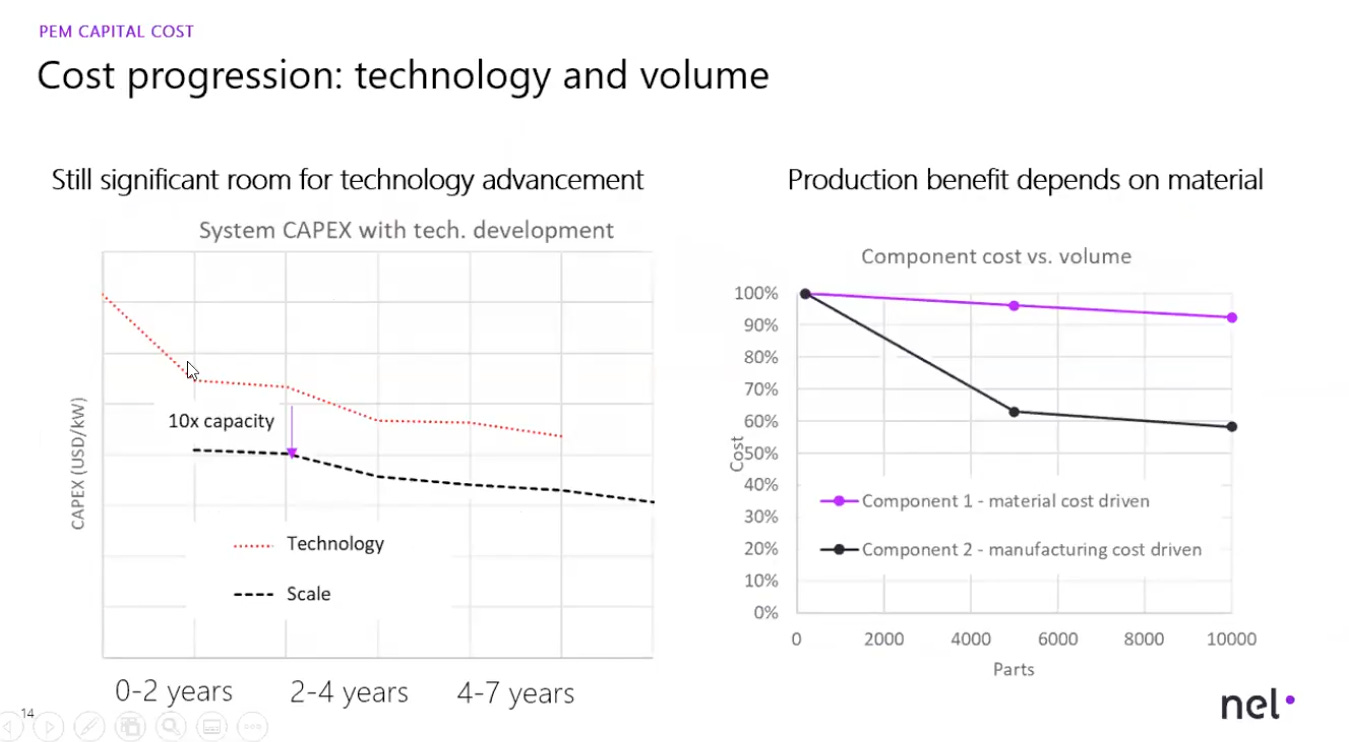

The third lever influencing LCOH₂ is the cost and efficiency of electrolyzers themselves. Electrolyzers are the newest among the magnificent four to benefit from learning curves. Their learning rate falls between 15-20%, slower than that of solar modules but faster than the learning rates observed in wind turbines and battery storage.

The U.S. excels at R&D and continues to pursue improvements in electrolyzer efficiency aggressively. The ultimate efficiency goal for electrolyzers is to lower the operating voltage as close as possible to 1.23 V, which is the theoretical minimum required to split water. The higher the operating voltage needed to operate the electrolyzer, the more renewable electricity will be required to operate it. Two key areas need improvement: activation overpotential, which is the extra voltage required to overcome sluggish reaction kinetics, and ionic overpotential, resulting from resistance during ion transport through the electrolyte.

To reduce activation overpotential, companies are exploring clever solutions such as nanostructured, high-surface-area electrodes and microporous layers, which improve electrical contact while maintaining proper water flow through the cell. To reduce ionic overpotential, companies like NEL are developing thinner membranes that still work with existing manufacturing processes, lowering resistance without sacrificing durability.

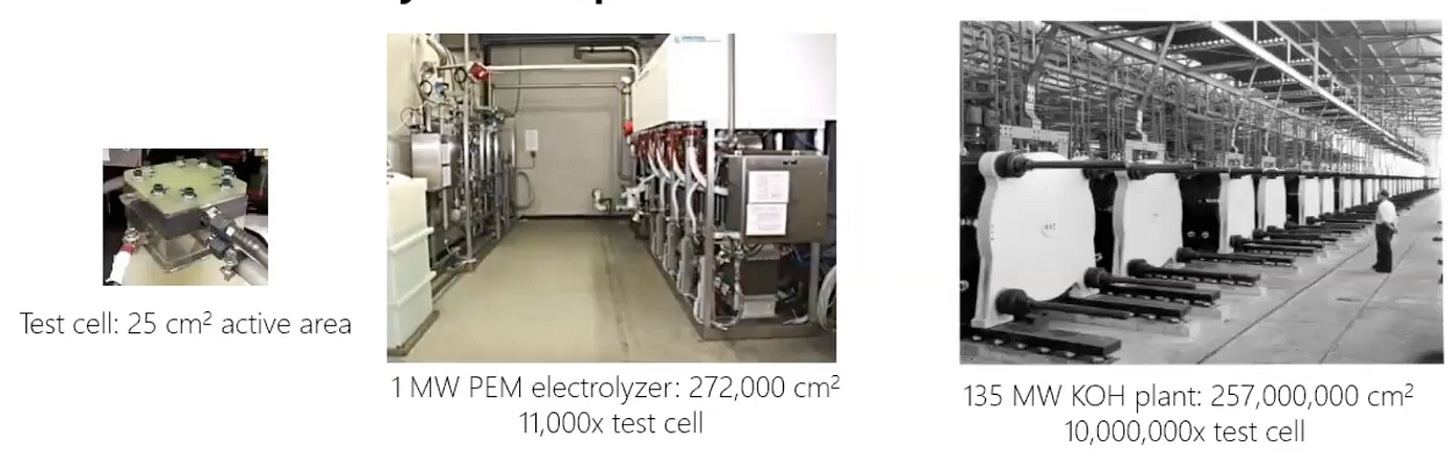

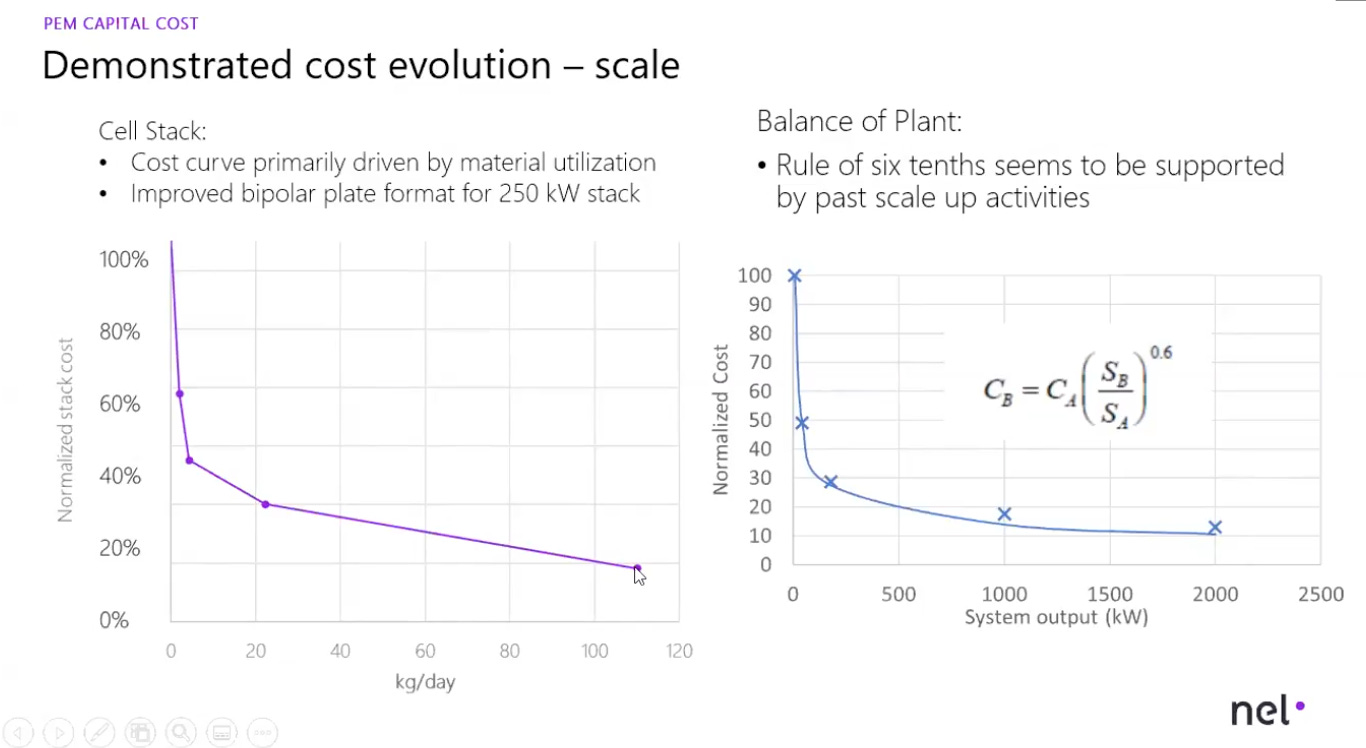

However, the U.S. continues to face significant hurdles in scaling manufacturing, mirroring its struggles in industries such as semiconductor or battery manufacturing. Why is this so important in terms of electrolyzer costs? Because of economies of scale (like Gen III nuclear reactors covered in our nuclear series). Being able to increase electrolyzer production to GW-scale manufacturing facilities achieves step-change cost reductions. At lower manufacturing rates, the stack is about 50% of the total stack manufacturing costs. With higher rates of production, stack costs can go down to 30%.

China, on the other hand, is playing smart by betting big on alkaline electrolyzers that run on simpler, cheaper materials. Meanwhile, the U.S. and Europe continue pouring resources into PEM electrolyzers—which cost about twice as much. America's bold strategy of matching electrolyzers with variable renewables still leaves one massive question unanswered: Can it catch China on costs?

And there's another wildcard in play: can emerging electrolyzer tech like AEM and SOE scale quickly enough to keep pace with established AE and PEM learning curves? Without speedy improvements in manufacturing, reliability, and system integration, these technologies could easily miss their chance to compete in a rapidly moving market.

Hydrogen Supply: My Takeaways

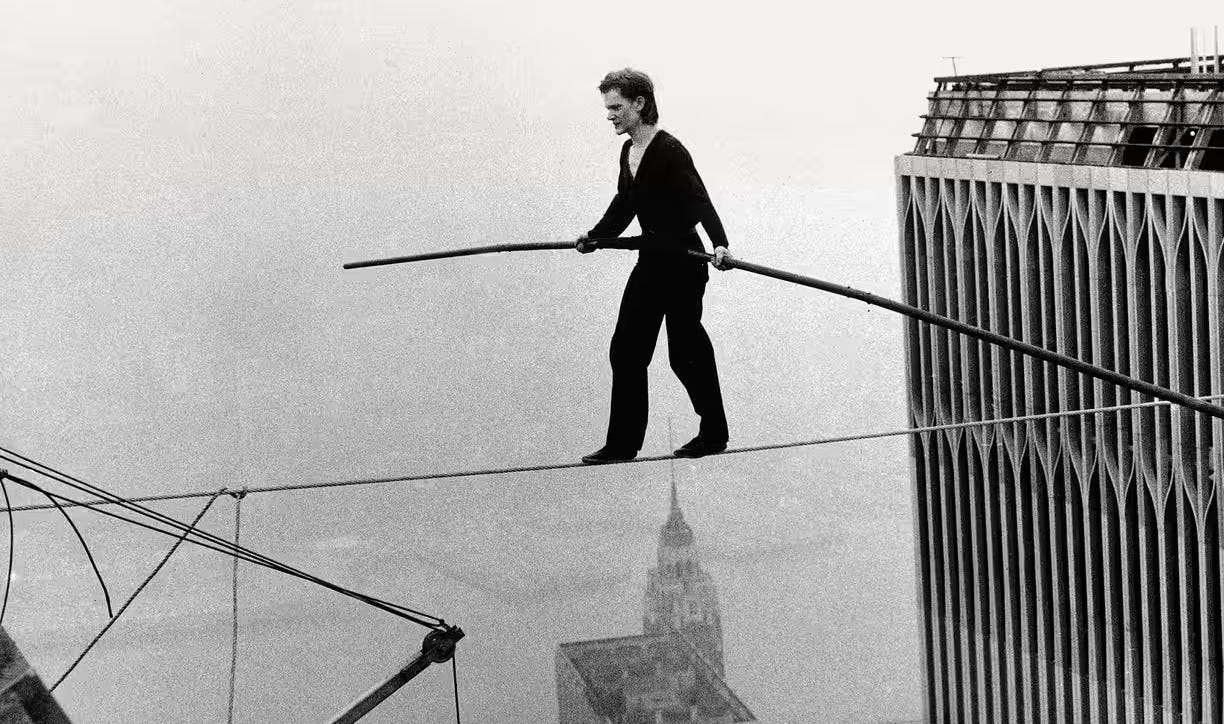

Hydrogen was the darling of clean tech in 2023. Now in 2025, that hype is not just fading. It is flatlining. The U.S. still has a shot at turning things around... it’s just walking a razor-thin tightrope to get there.

The U.S. must leverage every tool at its disposal to both increase electrolyzer module sizes and scale up stack production (ideally reaching gigawatt-scale manufacturing). Increasing plant size from 1 MW (the typical capacity today) to 20 MW could cut overall electrolysis plant costs by more than a third. Moreover, if at least 1,000 1 MW PEM electrolyzers were produced annually, the resulting scale-up could reduce manufacturing costs by up to 50%.

Before diving into the remaining open questions, here is my final takeaway:

Technological advancements in electrolyzers matter. But if we assume the marginal cost of electricity trends toward zero in the coming decade, scale will start to outweigh efficiency improvements. The numbers make this clear: efficiency improvements may reduce hydrogen’s theoretical cost by 20-25%, but scaling and learning effects could cut it by up to 70%.

So why are we still focusing most of our time and funding on boosting electrolyzer efficiency? The United States excels at producing breakthrough R&D, no question. But as electricity costs fall, a strategy centered on R&D becomes less economically sound for hydrogen supply.

Let’s walk through a simple example. The minimum theoretical energy required to split water is 1.23V, but real-world systems typically operate between 1.6-2.0V. Reducing these losses could lead to energy savings of 20-40%.

So what is the economic payoff?

Imagine a state like Texas, where electricity costs fall to $0.02/kWh. An electrolyzer plant runs at 2V with a 30% capacity factor and a highly optimistic capital cost of $1,000/kW. After years of development, a startup delivers a breakthrough system that is 30% more efficient, nearly reaching the theoretical energy limit. The result is a savings of just $0.38/kg of hydrogen, or a little over 13% of the total production cost.

Meanwhile, China is taking a very different approach by reducing system CAPEX and extending stack lifetime: scaling up simpler, low-cost AE stacks at about $300/kW and co-locating them with cheap renewables at a massive scale. It’s the right strategic move.

That brings us to a few open questions that could make or break the future of green hydrogen…

Hydrogen Supply: Open Questions

Will the U.S. be able to scale up the procurement of critical electrolyzer materials like iridium and platinum for PEM systems? Today’s global production of these precious metals can support (at most) 8 GW of annual PEM electrolyzer capacity. Yet projections suggest we’ll need approximately 100 GW of annual manufacturing capacity by 2030, an order-of-magnitude gap that remains unresolved.

Which electrolyzer stack (among PEMs, AEMs, or SOEs) has the potential to truly compete with China’s alkaline systems and scale to industrial production levels? Alkaline electrolyzers have been refined since the 1920s, giving China a significant head start. Personally, I’m more skeptical about whether any of the newer technologies can close the gap quickly enough. I’ll be exploring this question further in conversations with startups developing cutting-edge PEM, AEM, and SOE systems.

Will U.S. renewables get cheap enough fast enough? The decline in renewable energy prices is not a question of if but when. Right now, we’re still sitting around $0.06/kWh in most states. The clock is ticking: can enough regions get to ultra-cheap power in time for electrolyzer startups to survive and compete with grey hydrogen? It’s also why I’m more bullish on nuclear and geothermal. They’re not walking the same tightrope of cheap-enough renewables just to have a shot.